tax per mile reddit

We do pay per mile. 005 per mile would end up as a massive increase in the taxes you are paying.

Biden S New Vehicle Mileage Tax Program Will Charge Per Mile Driven Possibly Affecting Pizza Delivery Drivers Significantly R Talesfromthepizzaguy

My solution is not to find a way to tax them AND fuel vehicles by the mile plus gas tax.

. The standard mileage rate allows you to claim a business expense of 575 cents per mile driven for your Doordash and other deliveries for the 2020 tax year 56 cents per mile. For example if you drove your vehicle 1000 miles for IRS-approved business purposes in 2021 multiply 1000 miles x 056 per mile. However after a couple months she decided to go a different direction and left that job.

This article is reporting that they are expierementing with charging a gas tax by the miles driven vs. Youll be able to deduct 560. In section 13002 of the bill the pilot outlines that data can be.

Due to taxes she only received about 6800 of that money. A driving tax proposed by President Joe Biden would cost Americans 8 cents per mile. This means that 545 cents or 0545 must be multiplied by the number of business miles driven to determine the amount that you deduct from the money that you earned.

While Congress and the states kick around proposals to increase funding for infrastructure Robert Atkinson an opinion writer for The Hill has backed the idea of charging big rigs taxes based on the number of miles they driveCertainly not a new idea pilot programs for a per mile tax have been ongoing in several states although it is an idea that has. Standard Mileage Rate for Business. The first major concern with a per-mile tax is in how the data would be collected.

A vehicle mileage tax or vehicle miles traveled fee would charge motorists a fee based on how many miles they drive. My wife started a new job and received a 10000 starting bonus. What is the govt.

11 gal used at 24 cents a gal 264. More efficient cars end up being nailed worse. Despite President Joe Bidens supposed red line on raising taxes for those making less than 400000 the draft infrastructure bill in the Senate includes a national motor vehicle per-mile user fee pilot program.

Not implementing it is punitive to urban areas that have to pay tens of thousands per mile of road per year in maintenance costs for a couple people who want to live in the middle of nowhere. To use the standard mileage rate for a car you own you need to choose this method for the first year you use the car for business. However electrics dont pay this taxfee and drive as many miles as they like on our roads for free.

Its called a fuel tax on every gallon of gas or diesel. In other words a TDI in Oregon that gets 500 miles on a tank would pay 12 centsmile 600 vs. What S Your Single Highest Paying Load Ever.

Americans should not allow GPS tracking of cars trucks. The rate for business travel expenses has dropped from 575 cents per mile in the 2020 tax year to 56 cents per mile for 2021. The IRS has announced that the standard mileage rate that can be used by delivery and rideshare drivers has increased from 585 cents per mile to 625 cents per mile.

The rate for business travel expenses has dropped from 575 cents per mile in the 2020 tax year to 56 cents per mile for 2021. Aug 8 2021. Posted by 7 years ago.

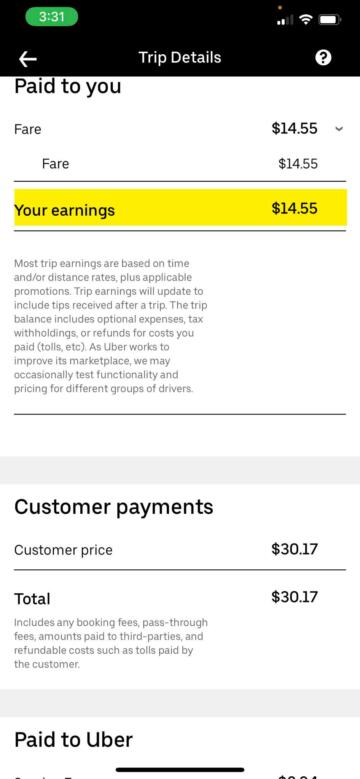

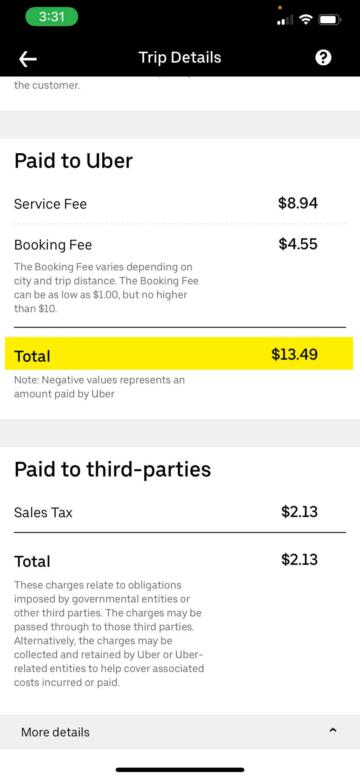

Deductible business miles include driving to work-related functions meeting clients and going to job sites. Log In Sign Up. Text above the screenshot adds the.

Tax Per Mile Cometh. Search all of Reddit. A tax per mile.

The timing of a vote on a 12 trillion infrastructure package divided House Democrats this week. Due to not fulfilling her contract she had to pay back the full 10k to the company even though she didnt actually receive that much. With the rise of electric vehicles cars with better miles per gallon and decreased personal travel during the COVID-19 pandemic revenue from the gas tax has declined.

Yet the new per-mile user fee pilot outlined in section 13002 of the bill does leave those people open to tax vulnerabilities pegged to personal vehicle mileage. A tax per mile. 19 cents per mile.

As an Amazon associate and affiliate for other products and services I earn from qualifying purchases. American drivers could soon trade paying taxes on gas at the pump for owing the government annual per-mile user fees under a new pilot program recently passed by the Senate in Joe Bidens 12. Mileage rate per mile.

You can get a deduction for the number of business miles multiplied by the IRS mileage rate545 cents per mile as of 2018. The four cent per mile increase is effective July 1 2022. DoorDash driver fired after confronting.

We do pay per mile. If that remained in the bill it would take future legislation in order for Biden to keep his promise not to raise taxes on. A vehicle mileage tax or vehicle miles traveled fee would charge motorists a fee based on how many miles they drive.

June 18 2022. 54 cents per mile for business miles driven. If your car gets 24 mpg now youd be paying 120 in tax based on mileage vs the 060 if paying per gallon.

Simply put if you drive a vehicle you would pay money to the government for. A per-mile usage tax provides a workaround however for those reluctant to change the gas tax and at the same time may provide Uncle Sam with much more than just revenue all at your expense. Everlance X Doordash Live Tax Q A With A Tax Expert Jan 24 2020 Youtube If you paid 300 in interest and 50 of miles are business you can deduct 150.

Pay Per Mile Tax How Would It Impact You R Ukpersonalfinance

Infrastructure Bill Includes Per Mile Road Tax Test That Will Track Drivers Travel R Futurology

/cdn.vox-cdn.com/uploads/chorus_asset/file/22720623/01_HEADER_1600x900.png)

The Chowchilla Bus Kidnapping What Happened All Those Years Ago Vox

Secretive Algorithm Will Now Determine Uber Driver Pay In Many Cities The Markup

Traffic Why It S Getting Worse What Government Can Do

The Best Times To Doordash In 2021 With Tips From Reddit

/cdn.vox-cdn.com/uploads/chorus_asset/file/18332708/Co2Plane_loop__jpg.jpg)

Flying Shame Greta Thunberg Gave Up Flights To Fight Climate Change Should You Vox

3 6 Miles Of Protected Bike Lanes Coming To Se 136th Avenue Bikeportland

How To Make The Most Of Work Vehicle Expenses On Your Tax Return Cbc News

How To Earn 7 500 Air Miles Bonus Miles For Free Milesopedia

Uber Drivers Often Unaware Of Tax Obligations Cbc News

Infrastructure Bill Includes Per Mile Road Tax Test That Will Track Drivers Travel R Futurology

The Absolute Best Doordash Tips From Reddit Everlance

Secretive Algorithm Will Now Determine Uber Driver Pay In Many Cities The Markup

Pay Per Mile Tax How Would It Impact You R Ukpersonalfinance

Gas Vs Electric How Much You Can Actually Save By Switching To An Ev Ctv News

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/18334678/FLYING_SHAME_CHART_edited.jpg)

Flying Shame Greta Thunberg Gave Up Flights To Fight Climate Change Should You Vox